Every company that has been in business for any length of time has customer complaints. It’s just the nature of consumers. However, when it comes to collections, not only are there more complaints than a regular business but when the complaint is submitted via the CFPB complaint portal, the company is required to answer them. Ignoring a consumer complaint in a collections matter could result in action from the Consumer Financial Protection Bureau (CFPB).

However, consumer complaints also provide insight into customer satisfaction. With the ease of use of the CFPB complaint database, you can look for trends in customer complaints and use that information to target improvements within your company.

What is CFPB Complaint database?

The CFPB’s complaint database was launched in 2012. It was created to allow consumers another platform to voice their complaints against a company about a financial product or service. It was also created to provide the CFPB insights into the problems consumers were having in the marketplace and to help the CFPB regulate consumer financial products and services.

Complaints are published after the company responds confirming a commercial relationship with the consumer, or after 15 days, whichever comes first. It is important to know that the CFPB does not verify the allegations in the complaints.

What is a CFPB Complaint?

The CFPB accepts complaints from consumers on financial products or services. If a consumer is not sure if their situation is an actual ‘complaint’ the CFPB has helpful tools on their website to help consumers determine if they have a complaint.

Consumers can choose nine products, and dozens of sub-products to help categorize their complaints. The main products include:

- Checking or savings account

- Credit card or prepaid card

- Credit reporting, credit repair services, or other personal consumer reports

- Debt collection

- Money transfer, virtual currency, or money services

- Mortgage

- Payday loan, title loan, or personal loan

- Student loan

- Vehicle loan or lease

While many of the entries into the CFPB’s complaint database are valid complaints against a company, many are just requests for information or verification of a debt from a company. So merely looking at the number of complaints filed against a company is not necessarily representative of actual complaints.

What Happens After a Consumer Files a Complaint?

The CFPB provides a workflow showing the typical process for what happens after a complaint is submitted.

- The complaint is submitted by the consumer. This can happen via their complaint portal, mail, fax, email, or telephone. Or another government agency that has received a consumer complaint may forward it to the CFPB. If the consumer is using the portal, they must create an account, and log in to submit their complaint online. The consumer will receive email updates and can log into the portal to track the status of their complaint.

- The complaint is reviewed by the CFPB and routed to the company who the complaint is against. The CFPB will work with that company to get a response. The CFPB may forward the complaint to another government agency if they decide the complaint would best be handled by that agency.

- The company responds. After a review of the complaint, the company must respond. They will communicate to the consumer as needed to obtain any additional information needed. They will report back about the steps taken or steps that will be taken to address the issue. Companies generally respond within 15 days, and a final response is generally provided within 60 days.

- The complaint is published. Certain information about the complaint is published on the CFPB’s complaint portal; the subject, sub-topic, date of the complaint, and often the comments and description of what happened (with permission of the consumer – and with personal information redacted).

- Consumer Review. Once the above steps are completed, the consumer has an opportunity to review the results/response from the company and has 60 days to provide feedback about the company’s response.

How to Respond to a Complaint in the CFPB’s Complaint Database

Your compliance management system should contain a process for responding to consumer complaints. It is also a best practice to have a field within your complaint entry process to identify where the complaint came from, for example, the CFPB, phone, letter, email, website, chat, etc. In addition to the consumer, account, and complaint details, your complaint process should also contain information on how your company handled the complaint, including who worked on it, the timeline, and the outcome.

The CFPB has provided a Company Portal Manual for companies to use when responding to complaints in the consumer complaint database. Section 1.3 of the manual lays out the nine-step complaint process, beginning with the consumer’s submission of the complaint, and continuing through the final publishing of the complaint and the company’s response:

Source: CFPB Company Portal Manual

- Consumer submits complaint by web, telephone, mail, fax, email, or another agency refers the complaint to the CFPB.

- Consumer Response screens the complaint about completeness and sends it to the company identified by the consumer via the secure Company Portal for response or refers it to the appropriate regulator.

- Company reviews the complaint, communicates with the consumer as appropriate, and determines what action to take in response.

- Company responds to the consumer and the CFPB via the portal.

- OPTIONAL: Company selects from a structured list of public company response categories.

- CFPB invites the consumer to review the company’s response by logging into the secure Consumer Portal or calling the CFPB’s toll-free number.

- Consumers are given the opportunity to provide feedback to the CFPB and the company about the company’s response.

- Complaints are published in the Consumer Complaint Database when the company responds to the complaint confirming a commercial relationship with the consumer, or after the company has had the complaint for 15 days, whichever comes first. With consumers’ consent, scrubbed complaint narratives will be published when the company selects an optional public response or after the company has had the complaint for 60 calendar days, whichever comes first. Complaints can be removed if they do not meet all the publication criteria.

- Complaint data and information is shared with other offices within the CFPB, including but not limited to Enforcement and Supervision, as necessary.

How Do I Access the CFPB Complaint Database?

The CFPB provides public access to the complaints database through their website. Navigate to the “Data & Research” tab, and then click on “Consumer Complaint Database”. There are several ways to access the data, you can download the entire database or download a portion of the database.

You can also perform an interactive search right on their website, which also allows for filtering by product, sub-product, date range, state, zip code, and company name. You can also choose to view only those complaints that contain the consumer’s narrative. Once you have entered in your information, you can choose to view in a map view, graphical trends, or a list of the complaints.

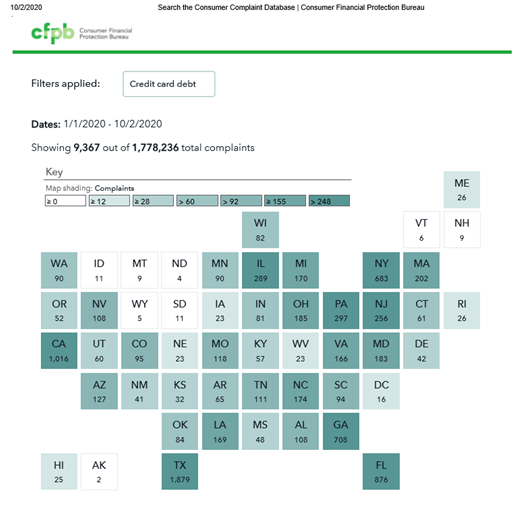

For the example below, I chose:

PRODUCT: Debt Collection

SUB-PRODUCT: Credit Card Debt

DATE RANGE: 1/1/2020 – 10/2/2020

Source: CFPB Complaint Database

How to Use the CFPB Complaint Database to Your Advantage

There is a goldmine of information in the complaint database, and it is free to use for anyone. Here are just a few of the ways a financial institution can utilize the database (outside of replying to your own complaints):

- Research a company you intend to do business with

- Keep tabs on the collection agencies who are your current third-party vendors, and use them as part of your annual audit

- See what trends are happening with consumer complaints during different time periods and compare them with what you are seeing internally

- Review your financial institution’s complaints and compare them to your peers

- Use it to identify and fulfill consumer needs – review common complaints from consumers and determine if there is something missing that your company can help fulfill

Consumer complaints are a window into your financial institution’s interactions with your consumers. They should be used to identify places that need improvement. Having a thorough and organized complaint response process will allow you to respond to complaints quickly and ensure a complaint isn’t lost in the shuffle.

At NeuAnalytics, we provide solutions built in compliance to ensure your company can handle any potential complaints in a timely and organized manner. We offer additional services and platforms that can also monitor your third-party vendors and your collections process, ensuring you are operating in a compliant and regulated manner. Please contact our team of experts to learn more about how NeuAnalytics can make a difference for you.