This article was originally published on October 28, 2020, and was updated on November 23, 2021, for context and clarity.

Distinguishing Between Disputes & Complaints Versus Fraud

Researching, responding, and tacking consumer disputes and complaints is complicated work, but it’s made more complicated when suspicion of fraud is involved. Banks generally have departments that handle frauds, disputes and complaints, and those departments are generally on different systems. So, linking together a fraud, and a complaint or a fraud and a dispute when they happen can be difficult at best, impossible at worst.

But before we explore how to overcome these issues, let’s take a closer look at common circumstances and provide some additional insight on how to handle them. There are several different types of fraud that financial institutions must be aware of and address:

Lost or stolen card:

- Card Not Present – fraudster obtains credit card number, expiration date, and CCV illegally, and then uses it to shop online or via phone orders.

- Account Takeover – hacker obtains the cardholder’s data, acts as though they are the real cardholder, reaches out to the credit card company, reports the lost card, and changes address at the same time. The new card goes to a different address. The fraudster now has the card.

Fraudulent Applications for Credit:

- Identity Theft – fraudster takes over someone else’s identity (from Phishing, Spam, Click Bait, etc.)

- Sleeper Fraud – A fraudster opens a credit card using false info, uses the card, but pays a minimum payment for months, or even years then maxes out the card and ‘disappears’.

- Synthetic Fraud – fraudster uses a real name, address, and SSN but from three different people. Each element is correct, but together they are a fake identity. Fraudsters will use this method to create a complete new identity, build up a credit footprint by obtaining different credit cards, and identifying documentation such as a library card, phone number, etc. Many times this is not detected until the synthetic identity has maxed out several credit cards, at which time they will simply disappear.

- Mail-Intercept Fraud/Mail Non-Receipt Fraud – fraudsters steal information such as email usernames and passwords, which provide enough information for them to hack into personal or business accounts. They then monitor incoming emails that contain personal or private information (such as bills/invoices) that may have banking or account information. This information can be used to access existing accounts or used to create new accounts.

- Data Breach/Hacking – fraudsters can obtain valuable personal and account information via hacking into systems. Hackers are getting very creative with spam and phishing emails, in hopes of obtaining access to a system that will allow them to access and steal information. Once in the hands of the hackers, the information is either sold or used by the hackers themselves to open fraudulent accounts, or fraudulently access existing accounts.

Counterfeit/Skimming

A fraudster will tamper with an ATM or other cash machine by implementing phishing card readers at the card input slot that will transfer the card information to them (skimming). Once they have the card info – they can create a whole new card and use it.

Once the fraud is detected, the financial institution must take immediate action to attempt to reduce the amount of money stolen by the fraudster.

How is Fraud Detected?

Depending on the type of fraud, such as sleeper or synthetic fraud, it may take a while to detect. The consumer may also report a fraudulent purchase or a bank may flag a suspicious transaction, such as large amounts of cash transferring across the globe.

Certain data companies also offer products or services to help with fraud detection, which can help determine if the data belonging to prospective new customers are an accurate name, address, and social security number.

Most financial institutions have some sort of technology and analytics in place to help with fraud detection. A change in charging/spending habits and patterns is often picked up automatically, as it is commonly an the initial indication of fraud.

This is a fishing expedition to see if the card is valid. A charge of a few cents up to a few dollars may initially appear on your statement. Once they know the card is good – they will continue to use it until it is denied.

Regardless of how the fraud is initially identified, once an account is flagged, there is likely a manual review process to research. But what is often overlooked in this process is the complex issue of communication between those who research the suspicious transaction and your collection team.

Collection activities are often-times handled from a different host system from the financial institution’s regular CRM. If an account is moved from your regular CRM to your collection CRM, the account may not be properly flagged as a fraud in the collection environment.

This may result in calls to an incorrect consumer, wasted time, money, and effort in trying to skip trace a synthetic identity, letters going out to incorrect consumers, or turning over of the account to a collection agency. All of this could result in a complaint or dispute by a consumer.

Consumer Disputes

A consumer dispute arises when a consumer does not agree with certain information relating to their account. It could be a dispute of a credit card charge, a fee, a balance, the existence of the account itself, or any number of other reasons. Often, determining what constitutes a dispute can be tricky.

If a consumer calls to ask the balance of the debt and asks for the most recent statement – are they disputing? How about if they say they can’t remember this account and need more information? Or that their ex-spouse was supposed to pay it in the divorce agreement?

Under the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA), Collection agencies are required to report and verify disputes made by consumers about activities on their credit report. Both regulations have guidelines and timelines that you must be aware of inaccurately responding to a consumer dispute.

While original creditors collecting on their debt don’t have to abide by the FDCPA, if the debt is turned over to a collection agency, that agency will generally request additional information from the original creditor when a dispute arises – this is called verification of debt (VOD).

When this happens, both the collection agency and the creditor are responsible for getting the information quickly in order to respond to the consumer. Additionally, if the debt has been reported to a credit bureau, the debt must be marked as “disputed” until it is resolved.

What is the Timeline to Respond to a Consumer Dispute?

If the dispute is originally made to the consumer reporting agency (CRA), the CRA has a defined process under the FCRA that they must follow, which includes a timeline. The CRA has 30 days to reach out to the original creditor, data furnisher, or source of the information being disputed, and reinvestigate.

In these instances, the original creditor or the collection agency, whichever one reported the debt to the credit bureau or both if both reported it, must review their documentation, and report back the results. Oftentimes, this process is handled through the e-Oscar platform.

Consumer Complaints

A consumer complaint is different from a dispute but could converge at some time. With a dispute, the consumer is questioning the factual information relating to their account. However, in a complaint, the range of topics is nearly unlimited. Additionally, there are several different ways a consumer may file a complaint, and it can be filled with many different entities.

A consumer can file a complaint with the Better Business Bureau (BBB), the Consumer Financial Protection Bureau (CFPB), the FTC (Federal Trade Commission), their State Attorney General, or directly to the creditor or collection agency, whoever their complaint is against. Furthermore, the complaint can be submitted in any number of ways; verbally, in writing, via text, email, voicemail, chat, or any other the consumer would like, and all ways must be treated equally as important.

The complaint itself can be a variety of things, a few of the more common complaint topics related to collections are listed below (note this is not a comprehensive list):

- A previous dispute was not handled properly

- A collector mistreated them on the phone, text, email, voice mail, chat, or in-person

- A collection letter did not contain the required regulatory language

- A collection agency didn’t have proper notifications on their website, letters, phone message, etc.

- A collection agency or creditor was unfair, deceptive, or abusive under the terms of UDAAP (Unfair Deceptive Abusive Acts or Practices)

- A collector made misrepresentations under the FDCPA (i.e. threatening to sue when they don’t have the ability to, threatening to arrest, etc.)

- The debt being collected does not belong to the consumer

- Threaten to contact a manager, superior officer, relative, neighbor, or other person and share information about the debt.

- Calling or texting a cell phone without permission (also a TCPA violation)

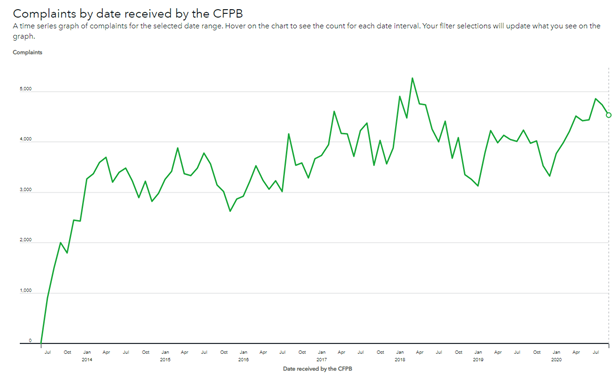

The CFPB Complaint Portal went live in June 2013 – since then, there have been increasingly more and more complaints filed with the CFPB relating to debt collections. For additional information on the CFPB complaint process, see my blog post “Using CFPB Complaints to Assist Portfolio Management.”

Source: www.consumerfinance.gov

It is a best practice that the creditor or collection agency act quickly to resolve the complaint. Most likely the complainant will be made by a consumer concerned for their data and records. The complaint could also be submitted by a third party on the consumer's behalf, but it still should be treated as a request from a client and the creditor or agency should work to resolve the issue quickly to the consumer's satisfaction.

If the complaint comes through the consumer’s attorney, the creditor or agency must get their own legal counsel involved immediately. With the increase in the number of consumer attorneys looking to represent large classes in class action lawsuits, it is important to immediately address any concerns and resolve them immediately. Especially when they relate to a repeatable issue that may have happened numerous times, such as incorrect language in a letter.

In these cases, attorneys just assume that every letter sent to a consumer had the same incorrect language, and the situation is ripe for a class action.

The Intersection of a Fraud, Dispute, and Complaint

While one activity could spur all three, it is more likely that two of the three would be involved in an overlapping situation: fraud + dispute or fraud + complaint or dispute + complaint.

In scenarios like this, if your company is using disparate systems, it’s best to try to identify where this overlap has occurred. If you can identify that fraudulent activity is the source of the problem on their accounts, you can save time and, more importantly, a lot of frustration to the consumer.

For collection agencies, the situation is even more difficult because they likely do not have access to the fraud database or information in their creditor client’s system. Even if the consumer does not mention fraud, the agency should immediately contact their creditor client to inquire if they have had any notification of fraud on the account.

The best practice for creditors is to always check your host system for fraud prior to sending an account into internal collections and checking again before forwarding it to a collection agency or law firm. If a fraud report comes in and the account has already been sent to collections, the account should immediately be recalled until the fraud has been properly researched and resolved.

If an account goes into collections, and the consumer seems to have disappeared off the face of the earth, it may be a case of synthetic fraud. Before committing too much time, effort, and money to skip tracing, it’s worth a scrub past a data vendor that offers a synthetic fraud scrub. If the consumer didn’t exist in the first place, it’s not worth trying to locate them.

Creating and maintaining a well-operated fraud dispute and complaint process can go a long way in stopping future mistakes. Keeping you and your team focused less on frustration and more on customer satisfaction.

If you need assistance with developing a complaint and dispute system, NeuAnalytics can help. We can provide the solutions and resources you need to focus on delivering satisfactory results for your consumers and clients. Talk with one of our experts today!