In March 2021, a creditor discovered one of its agencies sent 10 million email correspondents before the expiration of the required notification for consent. There was an issue with a date in the placement file versus the date emails sent. Problem?

Yes, but based on the CFPB Compliance Management System (CMS) examination manual, a creditor gets credit for possessing a (CMS), which discovers, reports, and mitigates systemic problems.

Comprehensive identification and management of risk fall under the Board and Management Oversight section of the examination manual. The manual indicates ratings of one through five, with one being the best. In this section, a creditor seems to get credit for identifying, reporting internally, and remediating the problem. The question is did the CMS discover the problem fast enough.

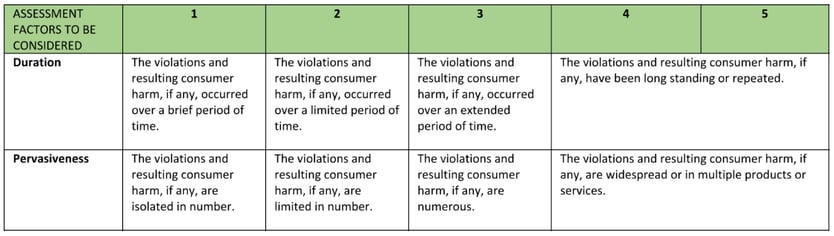

Measuring the harm falls under the compliance section of the CFPB examination manual. Duration and Pervasiveness are measured in Brief, Limited, Extended standing, or repeated. A well-built CMS leverages technology to measure controls and alert the creditor when problems arise. Serving as an insurance policy, the CMS can make the difference on whether the problem is Isolated, Limited, numerous, or widespread in Pervasiveness.

Debt collection agencies may not be fully ready for November 30, 2021. The example above will be a reality, though, that's just a fact. However, creditors seem protected from an agency-caused problem by having a well-built functioning CMS supported by technology to ensure control over Duration and Pervasiveness.

Take time now to prepare for the November 30, 2021 go-live of Regulation F. Talk to your vendors, talk to your staff, and get your people, processes, and platform ready because failure is not an option.

To learn more about NeuAnalytics and how we are preparing creditors for compliance with Regulation F visit us online to request a meeting with one of our compliance experts.

Our platform takes the guesswork out of monitoring your collection vendors, not only for Reg F compliance, but for dozens of other regulatory audits. Our automation gives creditors peace of mind when it comes to managing their vendors to the regulations by monitoring every account every day for compliance.

Watch the webinar November Go-Live for Modernized FDCPA here.